Starting a business is similar to other European Union countries. Citizens of the Eurozone do not need a residence permit.

Self-Employed in Croatia

A business, Croatian obrt, like in many countries, varies according to the type of activity and is divided into free (slobodni obrt), tied (vezani obrt), and artisanal (povlaštěni obrt).Registration in Croatia.

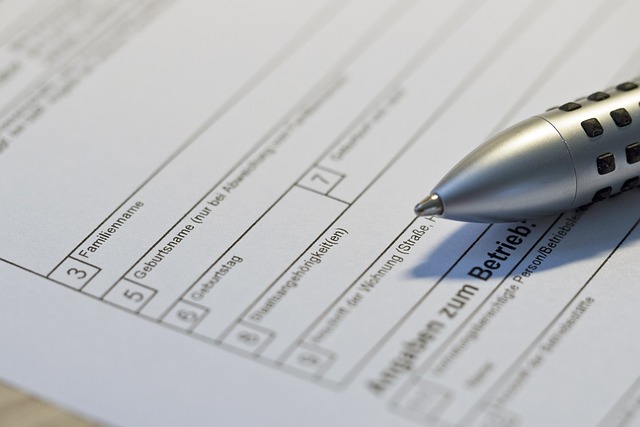

There are two registration options.- online via the e-Gradani application

- In person at the local business office (ured za registriranje obrta).

What You Will Need

For free businesses, these documents are sufficient- ID card or passport

For tied businesses and concessions, the following may be required:

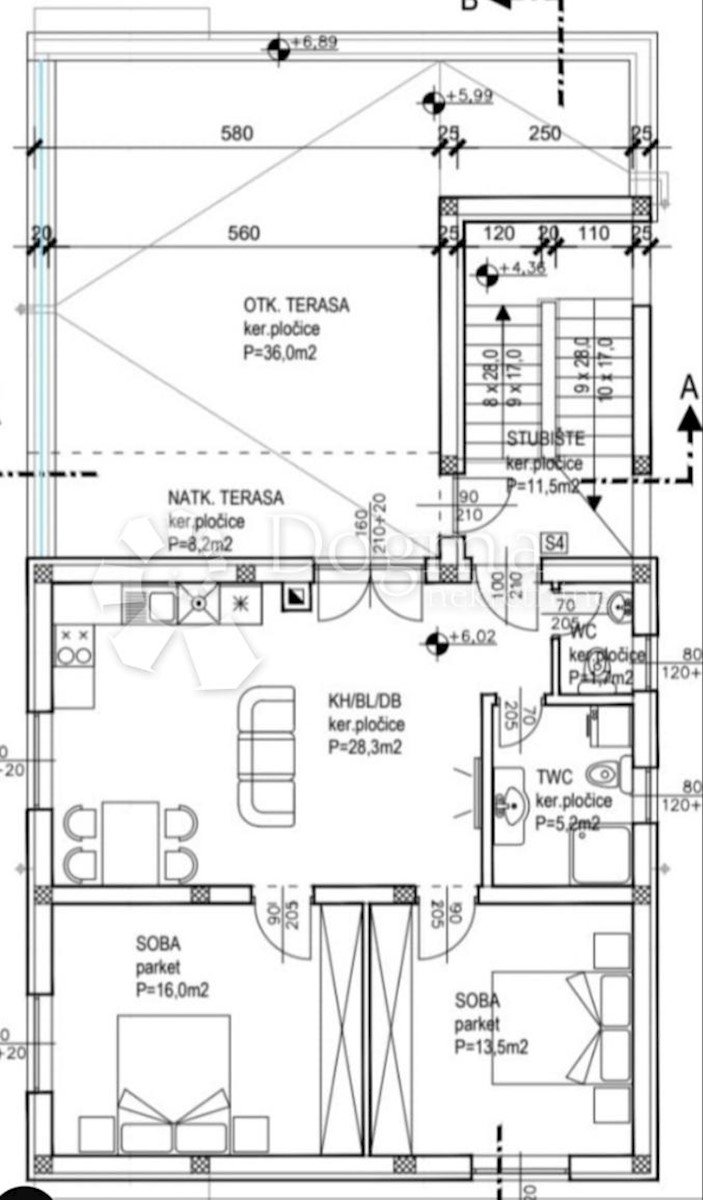

- Certificate of operation at your workplace - e.g., a lease or purchase agreement

- Registration in the business register (prijava za upis u obrtni registar)

- Proof of completed required education or achieved technical conditions - for tied businesses

After providing all the documentation, you will receive a so-called business license (obrtnica) for a fee of 35 EUR. Your details will be forwarded to the tax office (porezna uprava) and the health insurance company. Taxes for Self-Employed in Croatia In Croatia, incomes are taxed through a progressive tax rate. You can see it clearly in the following table.

| Income | Tax Rate |

| Up to 47,745.36 EUR annually | 20 % |

| Up to 3,978.78 EUR monthly | 20 % |

| Over 47,745.36 EUR annually | 30 % |

| Over 3,978.78 EUR monthly | 30 % |

Based on your income, your tax will be calculated as either 20 % or 30 %. However, a municipal surcharge tax is also added, known for example in Germany as "Gewerbesteuer". This increases the more inhabitants the community where you carry out your activity has. In smaller villages, it is minimal, but in Zagreb, it is 18 %.

| City | Municipal Surcharge Tax |

| Zagreb | 18 % |

| More than 30,000 inhabitants | up to 15 % |

| Less than 30,000 inhabitants | up to 12 % |

| Small villages | up to 10 % |